European Open: Dollar holds firm, GBP rises ahead of UK retail sales

2021-03-26

Asian Indices:

- Australia's ASX 200 index rose by 33.6 points (0.49%) to close at 6,824.20

- Japan's Nikkei 225 index has risen by 414.78 points (1.45%) and currently trades at 29,146.00

- Hong Kong's Hang Seng index has risen by 409.58 points (1.47%) and currently trades at 28,309.19

UK and Europe:

- UK's FTSE 100 futures are currently up 40 points (0.6%), the cash market is currently estimated to open at 6,714.83

- Euro STOXX 50 futures are currently up 30 points (0.8%), the cash market is currently estimated to open at 3,862.57

- Germany's DAX futures are currently up 108 points (0.74%), the cash market is currently estimated to open at 14,729.36

Thursday US Close:

- The Dow Jones Industrial rose 199.42 points (0.62%) to close at 32,619.48

- The S&P 500 index rose 20.38 points (0.53%) to close at 3,909.52

- The Nasdaq 100 index fell -18.37 points (-0.0014%) to close at 12,780.51

Asian indices higher overnight

Futures markets are broadly higher ahead of the open. Indices across Asia were mostly higher with the China CSI300 leading the pack and trading around 2% higher for the session. Hong Kong’s Hang Seng rose to a -day high with a 1.4% gain, and Japan’s Nikkei reclaimed the 29k handle and also traded 1.5% higher.

By yesterday’s close the FTSE 100, despite its best attempts not to, managed to close above its 50-day eMA for 19-consecutive days. The past five of which have seen lower spikes fail to push index materially lower. Incidentally this could be a sign of strength as these ‘buying tails’ suggest demand resides above 6,618. But we’d need to see a break above 6732 before becoming more confident a swing low could be in. And, until then, perhaps be on guard for another attempt to drive prices lower following yesterday’s bearish outside day. It’s a choppy one!

The DAX and STOXX 50 continue to look firm at their highs and are our preferred indices for any bullish bets on European bourse. Check out for a closer look.

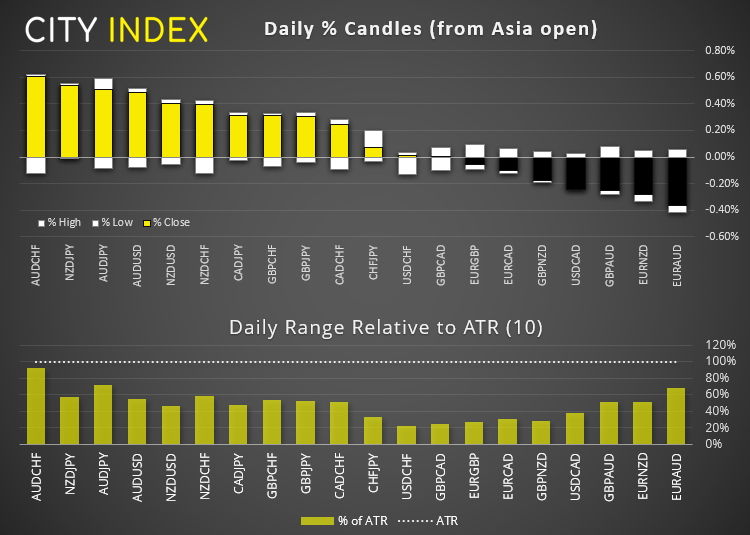

Forex: A classic risk-on display

AUD and NZD were the strongest overnight currencies among FX majors, whilst JPY and CHF were the weakest. Classic risk-on patterns for FX, although not overly volatile with all daily ranges remaining well below their 10-day ATR’s. AUD/CHF, NZD/JPY and AUD/JPY were the strongest pairs of the overnight session.

- EUR/GBP was the biggest mover yesterday (to the downside) and endured its most bearish session since early February. Now trading around 0.8560 and just I the lower third of the 0.8538 – 0.8650 range, bears could consider fading into minor rallies beneath 0.8596 – 0.8600 resistance, which is near the midpoint of said range.

- GBP/JPY rose to a 2-day high overnight after printing a bearish engulfing candle yesterday. Stronger than expected retail sales this morning should send it closer to the 150.92 high in the current risk-on (albeit mild) backdrop.

- GBP/AUD is trading near recent highs around 1.8000 and carving out a bullish channel. A weak print today may well send it lower but, structurally, appears ripe for bullish ‘dip’ buyers whilst the bullish channel continues to support.

Cable heads into a resistance zone ahead of retail sales data

Since GBP/USD broke to a new March low on Tuesday we have been waiting for prices to pullback into resistance to present a potential swing trade short opportunity. Now the pullback has occurred, it is crunch time.

Despite the strong US dollar overnight, cable has held onto its own and moved to a 3-day high. Now trading in the 1.3760/76 resistance zone, we would want to see evidence of bearish momentum from currency levels before considering any shorts.

- A break beneath the 1.3740 low (from the 15-mon chart) could be enough to confirm a swing high has been achieved.

- Under this scenario the bias would remain bearish beneath 1.3776.

- Yet a break above 1.3776 suggests further upside for cable and brings the 1.3800 handle into focus, just below the 200-bar eMA.

Commodities: Silver gets spikey, copper breaks $4.00

Silver prices fell to a 2-month low yesterday, yet all but erased the day’s losses to form a bullish pinbar above the 200-day eMA. Given we have seen similar patterns around $22 and, more recently $24 then we see the potential for a bullish follow-through if it breaks above yesterday’s high.

Copper prices closed beneath $4.00 yesterday as it tried to break south from a 3-week sideways range. They’ve opened up slightly above $4.00 in early trade but we are on guard for another dip lower before its bullish trend resumes. We’d be looking for support to build above the September 2012 high or the bullish trendline form the October low (whichever comes first).

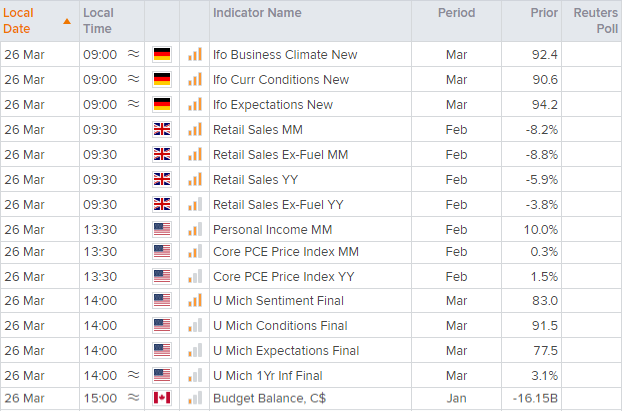

Up Next (Times in GMT)

You can view all the scheduled events for today using our , and keep up to date with the .

Germany’s IFO report kicks off data in the European session. Business climate is expected to tick higher to 92.4 (93.2 prior), although expectations are forecast to fall to 94.2 from 95.2. However, it is not clear whether expectations have accounted for Merkel’s U-turn regarding Germany’s Easter lockdown, so there amy be an upside surprise in there somewhere.

GBP pairs and the FTSE will be in focus around today’s UK retail sales report. UK retail sales slumped in February, although the general consensus is for retail to contract again, but at a much slower pace. Retail sales excluding fuel is expected to increase 1.9% in February (-8.8% prior) and fall -1.5% YoY (-3.8% previously). Including fuel, they are expected to rise 2.1% MoM (-8.2% previously) and fall -3.5% YoY (-5.9% previously). And let’s hope it does improve for GBP bulls, who had weaker employment and inflation figures to deal with .

You can view all the scheduled events for today using our , and keep up to date with the .

热门资讯

原油:WTI回调有助于长期看涨趋势健康发展

2024-02-10

美元价位行情:欧元/美元、美元/日元、SPX、黄金

2024-02-10

欧元价格展望:欧元/美元支撑位1.0500是超卖反弹还是底部?

2024-02-10

非农前瞻 — “美债火山“爆发下金银能否绝地反击

2024-02-10

黄金深度超卖,黄金/美元在美联储会议后继续回调

2024-02-10

一周展望:中美CPI、美股财报和地缘政治风险

2024-02-10

欧元/美元分析:地缘政治风险上升引发欧元下跌

2024-02-10

美元价位行情:欧元/美元、黄金、美元/加元、利率

2024-02-10